API Banking

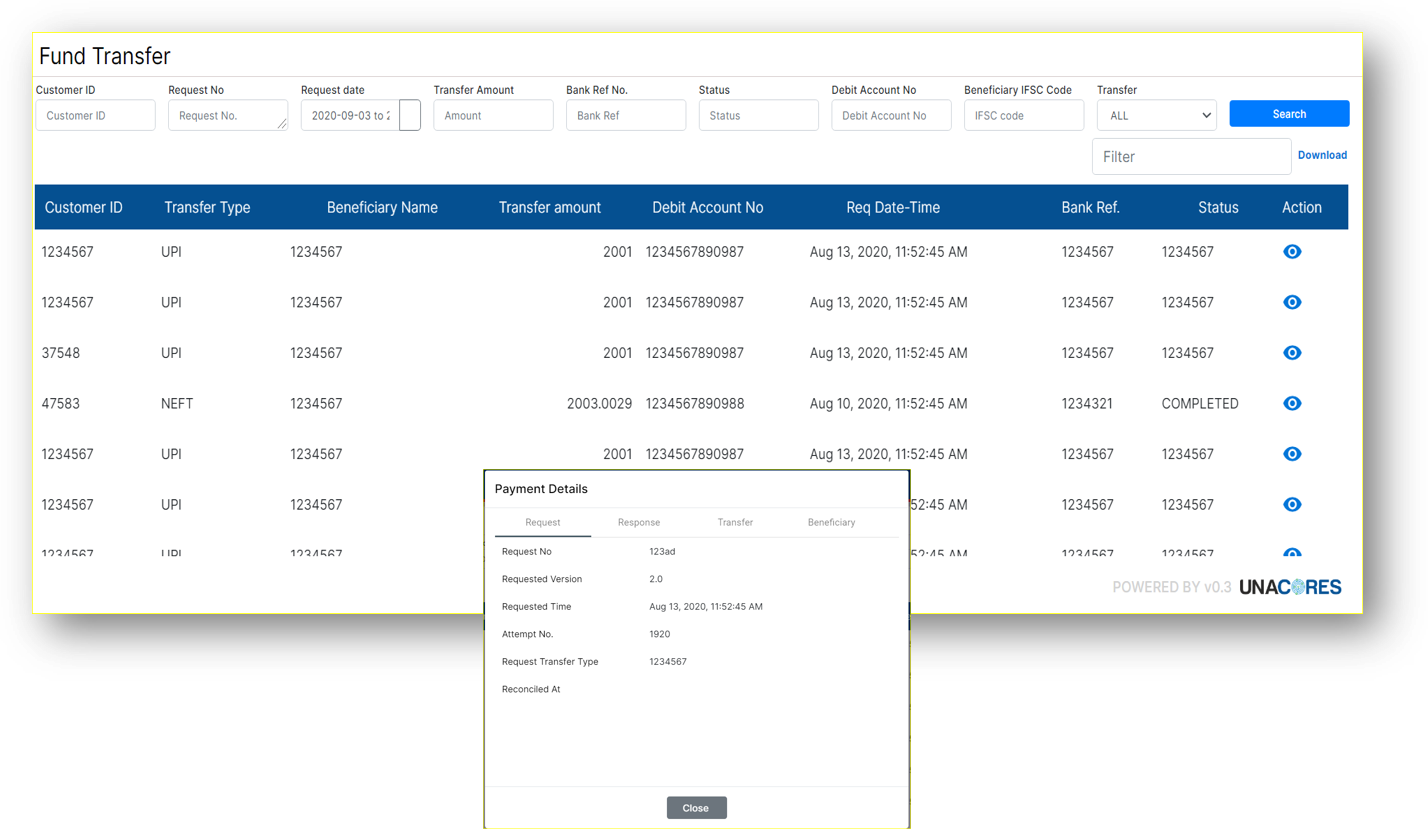

Application Programming Interface (API) Banking is a suite of simple, secure, smart interfaces for the bank’s corporate customers and partners.

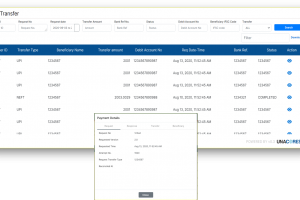

There are more than 100 + ready Financial API for launching Open Banking Solution. The suite includes a user interface for your business and operations teams to configure the behaviour of services (Service Center), a monitoring dashboard for operations and support staff (Console).